can you go to jail for not filing taxes in canada

Can I go to jail for not filing taxes in Canada. Answer 1 of 9.

How To File Overdue Taxes Moneysense

Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen.

. The penalty wont exceed 25 of your unpaid taxes. The IRS will charge a penalty for failing to file taxes. But you cant be sent to jail if you dont have enough money to pay.

How many years can you go without filing taxes in Canada. He could go to jail but it. In circumstances of willful fraud or tax evasion you may be criminally prosecuted.

CRA will likely arbitrarily file his taxes for him at some point and he will get a large tax bill. But you cant be sent to jail if you dont have enough money to pay. When taxpayers are convicted of tax evasion they must still repay the full amount of taxes owing plus interest and any civil penalties assessed by the CRA.

In addition the courts may fine them up to 200 of the taxes evaded and impose a jail term of up to five years. It is illegal to ignore Canadian tax law if you fail to file income taxes on time and the Canada Revenue Agency might view this as an attempt to evade taxationAn evasion of taxes has a big impact on not knowing it and also can result in jail time fines and the record of someone committing a crime. It depends on the situation.

The penalties for tax evasion are directly related to the offence. CRA Canada Revenue Agency does everything it can to help people make good on their taxesand they are very patient. Then he can submit his own inforeturns to lessen that bill.

However you can face jail time if you commit tax evasion tax fraud or do. The potential penalties for tax evasion Canada can be very severe. Can you go to jail in Canada for not paying taxes.

You can go to jail for lying on your tax return. Essentially this lets you haggle for a. If you do not the Canada Revenue Agency CRA could potentially charge you with a crime which could.

If you dont file federal taxes youll be slapped with a penalty fine of 5 of your tax debt per month that theyre late capping at 25 in addition to. Unpaid taxes arent great from the IRSs perspective. It is possible though it would have to be an extreme case.

This offence results in a fine of anywhere between 1000 and 25000 and up to one year in prison. Section 238 of the Income Tax Act states the penalties for failing to file a tax return if youre required to do so. Financial affairs and personal situations can be.

Since tax evasion Canada is a very serious charge it is important that you file your taxes correctly. You can go to jail for not filing your taxes. Most people dodge filing taxes because they know they cant pay.

Can You Go To Jail For Not Filing Taxes In Canada. If the CRA suspects he is hiding moneyfraud he could get audited. CRA will assume you are evading the payment of taxes.

Can you go to jail for not filing taxes in Canada. The United States doesnt just throw people into jail because they cant afford to pay their taxes. According to the Income Tax Act and the Excise Tax Act various types of crimes can carry a punishment such as jail time or fines of over 200 of avoided taxes.

Filing your taxes late and not filing your taxes at all can have severe consequences. Answer 1 of 4. Canadas Income Tax Act and Excise Tax Act set out various offences with penalties that include jail time as well as fines of up to 200 of taxes evaded.

There are many probable consequences related to unfiled tax returns. Truthfully you can probably go quite a few years without filing taxes in Canada but why would you. If you are found guilty you could face a large fine and even potential criminal charges that could result in jail time.

If you owe more than you can afford the IRS will work out a payment plan or possibly even an Offer in Compromise. Can You Go To Jail For Not Filing Taxes In Canada.

National Cba National Canadian Legal Affairs

Can You Go To Jail For Not Paying Your Taxes Tax Lawyer Tax Attorney Family Law Attorney

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

The Penalties For Late Tax Filing 2022 Turbotax Canada Tips

Bail Bell Bail Bondsman Bail Conroe

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Can I Go To Jail For Unfiled Taxes

When It Comes To Getting Tax Help Consider All Your Options The Globe And Mail

Cerb Overpayments And Penalties What We Know So Far Grant Thornton Limited Licensed Insolvency Trustees

Tax Planning And Saving Tips To Deal With Income Tax Debt Cairp

What Is The Penalty For Tax Evasion In Canada Pyzer Criminal Lawyers

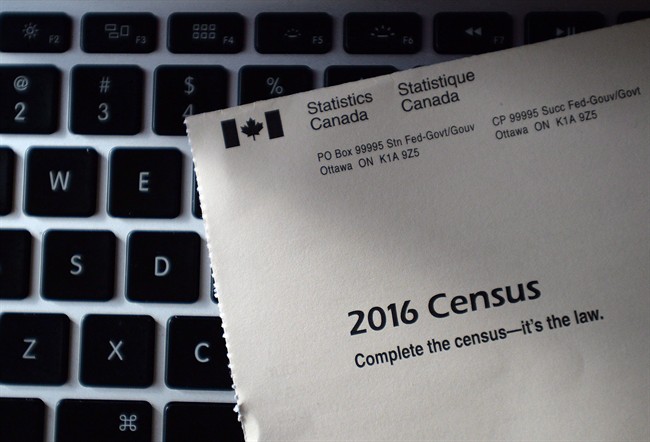

Some Canadians Didn T Fill Out The Census Could Face Fines Or Jail National Globalnews Ca

1999 Complete Monopoly 2000 Millennium 41295 Etsy Canada In 2022 2000 Completed The Originals