center for responsible lending overdraft fees

District of Columbia Office 910 17th Street NW Suite 800 Washington DC 20006. Financial institutions rake in billions annually from overdraft fees.

Banks Earning Less From Overdrafts But Critics Still Find Fault American Banker

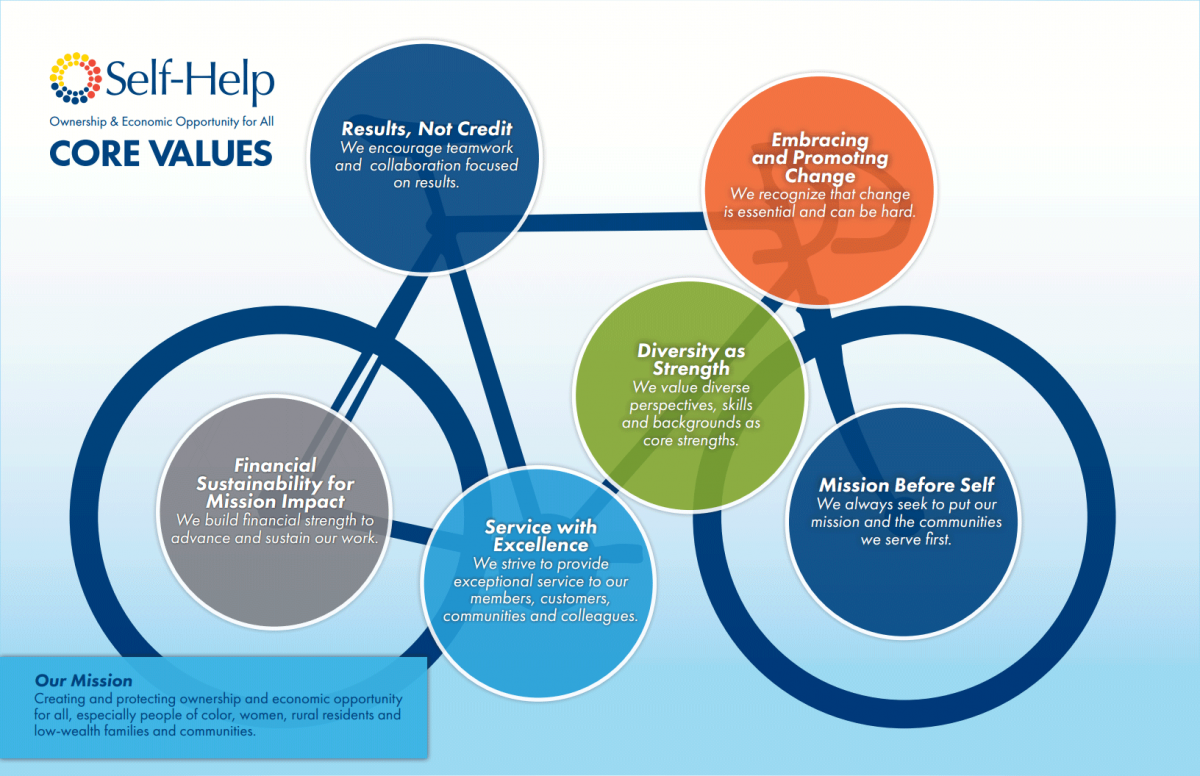

Founded in 2002 CRL plays a critical role in influencing policymakers to enact reforms in payday lending consumer mortgages overdraft fees credit cards and other areas.

. DURHAM North Carolina Feb. Center for Responsible Lending 302 West Main Street Durham NC 27701 919 313-8500. CFPB should take a closer look at overdraft fees crypto.

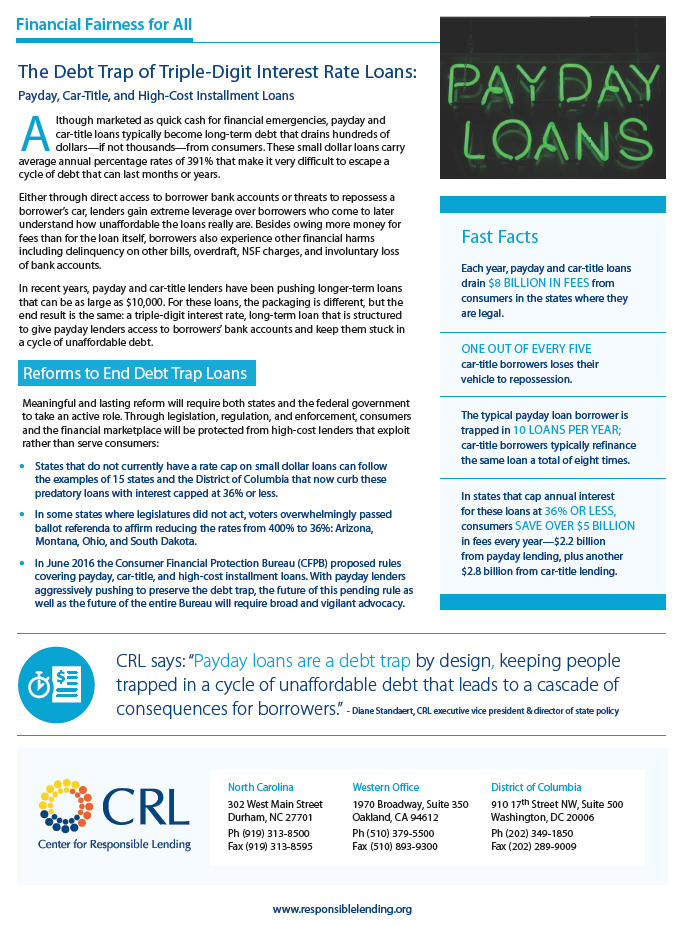

WASHINGTON DC--Marketwired - March 11 2014 - The Center for Responsible Lending CRL applauds Bank of America for taking another important step that. Never Pay Another Overdraft Fee. The Center for Responsible Lending CRL issued a report on June 3 calling on Congress to adopt legislation prohibiting banks from issuing overdraft.

Overdraft fees have had harmful effects on millions of consumers nationwide. Consumers the media and community advocates also regularly turn to CRL for information and recommendations to avoid or stop financial abuses. The bank took in 163 billion in overdraft fee income in 2015 the first year banks were required to publicly report overdraft fee revenues to regulators.

Some banks and credit unions recently have. Citigroup one of the five largest banks in America. Banks Must Stop Gouging Consumers During the COVID-19 Crisis.

Such revenue plummeted during the second quarter of 2020 as many banks waived fees to help customers through the early months of the pandemic according to Federal. Altogether customers of larger banks paid more than 11 billion for bounced checks and other overdrafts in 2017 according to the most recent data from the Center for Responsible Lending. 26-- The Center for Responsible Lending issued the following statement on Feb.

It is affiliated with the Self-Help Credit Union also founded by Martin Eakes in Durham North Carolina. Overdraft protection a feature of a checking account. Its up to regulators to stamp out excessive overdraft fees.

Center for Responsible Lending 302 West Main Street Durham NC 27701 919 313-8500. Established in 2002 by Self-Help CRL is a nonprofit nonpartisan research and policy organization that focuses on financial products and services including mortgages credit cards payday lending and bank overdraft fees. Wells Fargo drew fire after an August report by The New York Times revealed a policy that allowed the banks accounts to remain open even after customers thought they had.

BofA is miles ahead of. In some instances consumers can be charged as much as 35 for a purchase of 5 or less. Which total 175 billion per year according to the Center for Responsible Lending.

Center For Responsible Lending Linkedin

Tweets With Replies By Center For Responsible Lending Crlonline Twitter

Center For Responsible Lending Announces New Logo Center For Responsible Lending

Policy Counsel Center For Responsible Lending

Center For Responsible Lending Facebook

1 C Hapter 4 Banking Services Savings And Payment Services Overdraft Fees Now Average 35 Per Transaction That Was 31 5 Billion In 2012 Up From Ppt Download

The Debt Trap Of Triple Digit Interest Rate Loans Payday Car Title And High Cost Installment Loans Center For Responsible Lending

Center For Responsible Lending Crlonline Twitter

Follow Rebecca Borne S Rkborne Latest Tweets Twitter

Overdrawn And Overworked How Banks Are Still Screwing Consumers With Overdraft Fees Occupy Com

Center For Responsible Lending Facebook

Center For Responsible Lending Crlonline Twitter

Report Finds Bank Overdraft Fees Climbed In 2019 For Fourth Straight Year Morning Consult

Banks Will Get 30b In Overdraft Fees This Year Here S How To Avoid Them

Center For Responsible Lending Facebook

Abusive Overdraft Fees Drain Consumers Dry Center For Responsible Lending

Center For Responsible Lending Crlonline Twitter

Banks Make Billions Off Of Unfair Overdraft Practices New Orleans Multicultural News Source The Louisiana Weekly